Wednesday, April 12, 2023

Welcome back friends to Education (financial) Wednesdays on my B.R.E.A.T.H.S. blog. For this month, I am holding this space to share my financial education journey in the year which has been drastically different from how I managed my finances in the past. I realized with the recession we are in that now is the best time to get started on readjusting everything I know about financial literacy and each week this month I will be sharing with you the strategies I have learned. Last week, I shared about a book I came across last year called, “Profit First,” by Mike Michalowicz, and it helped me completely change my money management. This second week, I will be sharing my budgeting strategies from the past and present.

Budgeting in the Past

Before 2009, I did not budget. I would receive my monthly teacher’s salary on the first of the month and then spend everything I had by the end of the month living paycheck to paycheck. What I find interesting is that I only had a semester of budgeting in high school 15 years prior, but nothing else about how to manage my money. However, that all changed in 2009 when I was taught how to use Google Sheets where I would make monthly spreadsheets of my income and bills as well as write in my money journal in Google Docs. I still have all those copies and can see how I budgeted using my past budgeting strategies.

Budgeting in the Present

About nine years later in 2018, I joined a financial company who taught me more about financial security and freedom, but not much about budgeting. It wasn’t until this last year when I read the “Profit First” book that gave me better insight on how to manage my money specifically for my businesses, but also helped me with my personal budgeting and paying myself first before paying the bills.

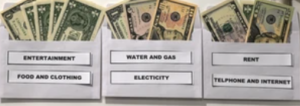

Envelope Budgeting aka Cash Stuffing

Mike Michalowicz (2017) stated he learned the cash stuffing method from his Baby Boomer mother who every two weeks would cash her paycheck and divide it into five envelopes: food, mortgage, community, fun money, and vacation. Other money managers like Dave Ramsey appeal to the Gen Zers with his cash stuffing methods into buckets or envelopes to help control monthly spending. There are now famous cash-stuffing Tiktokers who have used the strategy on their platform to reach the younger Gen Y and Z generations.

Conclusion on Budgeting Strategies

While I still use my Google Sheets to track my monthly income, I have set up a new spreadsheet to track how I spend each cent into four different categories: Bills, Food, Gas, and Fun. Currently, I use four different bank accounts across two different banks to do my electronic cash stuffing. One of my other favorite money management authors, Stuart Wilde (1998) explains how to start evolving to just paying everything with cash, which is eventually where I want to end up using the cash stuffing envelope strategy for my future budgeting strategy.

Thank you for reading,

Dr. Jaime Brainerd, E.d.D.

References

Michalowicz, M. (2017). Profit first: Transform your business from a cash-eating monster to a money-making machine. New York, NY. Penguin Random House, LLC.

Wilde, S. (1998). The little money Bible: The ten laws of abundance. Hay House, Inc. USA, Australia, UK, Republic of South Africa, Canada, and India.

Isn’t it sad that school barely teaches kids any life skills?

Good for you to take charge and be on top of your money. These days, as prices keep increasing, it’s all the more important to keep track of your dollars, right?

https://thethreegerbers.blogspot.com/2023/04/jockstrap.html

Budgeting money and time are always a good thing, so I appreciate you sharing this blog post.

I’ve always been one to budget and I’m a penny pincher! I’ve heard of the envelope method and it sounds interesting. My granddaughter uses envelopes for some of her budgeting. As for me I use CC for most everything and pay in full when the statement arrives. For me this is a win-win, I earn cash back from my card, I never pay interest (which is a big savings) and no annual fees.

Such a big topic to cover yet one people like to ignore especially these days!

I don’t think we had any real budgeting classes in school either. I especially needed that when I was younger!

When my husband and I were getting out of debt in 2008 and saving for a new home, we used the Dave Ramsey envelope system. That really helped you learn how much you were spending — or overspending! We stayed with this system until 2020. When there were issues with cash (and shortage of coin) at the beginning of the pandemic, we switched back to debit cards, but we have learned new habits that keep us from overspending.