Wednesday, October 19, 2022

Education (financial) Wednesdays

Welcome back friends to Education Wednesdays on my B.R.E.A.T.H.S. blog. For this month, I am holding this space to share my financial education journey for each of the decades I have been through, where I am at, and where I plan to be. For each of the four weeks I will be transparent, honest, and forthcoming with successes and burdens with my financial education through the years as a means to reflect and grow my financial literacy knowledge.

My Financial Education Journey: Years 19 to 39

The first week in October, I shared about the first decade of my experiences with money and a family of four children under ten living with our single mother. Last week, I discussed my financial education journey during my teen years. This third week, I am reviewing two decades, two marriages, two divorces, and a third chance at learning about money and finances.

My 1sts in Young Adulthood

1st Job

My first real job with a W2, benefits, a name tag, and black apron, was at a one-stop shop grocery chain called, Fred Meyer (or Freddy’s), located throughout the Pacific Northwest. I worked in the apparel department for a year, learned how to put together a brand new store, upgraded my folding skills, learned about produce codes, cash registers, clocking in/out, how to balance four monthly paychecks, and legal breaks (which we had in the unventilated indoor smoke rooms). Basically, I learned money is time, and time is money.

1st Apartment

When I was 19-20, I moved out of my small town over the hill to a larger city, Beaverton, OR, at St. Mary’s Apartments, and moved my apparel position to a new Fred Meyer store close by. I learned about renting an apartment upstairs, utilities, deposit/refund, late fees, sharing expenses, roommates moving in/out, and ultimately that it was really difficult to understand all that until I actually experienced it. I survived my first year living in an apartment and was willing to try it again with a few changes.

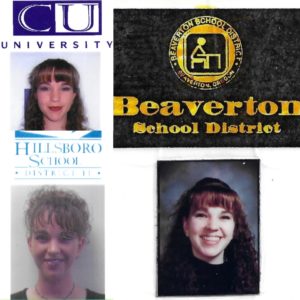

1st Year of College

Right out of high school, I had a handful of community college credits and met with a counselor who helped me arrange my school schedule around my work schedule (3 jobs) and the three different campus locations. My family could not pay for my college, so I had to work hard, and apply for financial aid. These are all new financial lessons that will eventually catch up to me later in life. In hindsight, I wish I would have taken better notice.

1st Marriage & Divorce

After a couple years of work and college, I decided it would be a better journey if I had someone to share it with and was married just a few months before I turned 21. This was a lesson similar to my last roommates, but it was a little different this time, everything was shared equally, and we genuinely cared about managing our time and money. Unfortunately, we didn’t focus enough on one another, or support each other in our journeys, which ultimately led to our divorce right at the end of college. Again, all these lessons I was willing to try over, and hopefully do better this time.

My 2nds in Young Adulthood

2nd Job – Starting New Teaching Career

Teaching in Oregon

After finishing college with my bachelors in education at Concordia University in Portland, I started my career as a multiple-subject (K-8th grade) teacher. My first job as a teacher was at a parochial K-8 school downtown Portland, OR, where I was the rotating substitute for all grades. My second job as a rotating 2nd grade teacher was at a grade school in the metropolis cities directly West of Portland. While those were great first teaching jobs, I was craving something much bigger; a more challenging teaching environment, more sunshine, and more money. Those were the top three things that motivated me to move from my home state of Oregon to the Golden State of California.

Teaching at University of Phoenix Online

My second major teaching job was at the University of Phoenix as an online facilitator for their college of education. This was a nice addition to my career, not so much for the supplemental income, but for the online teaching experience that lasted for 10 years. I was building foundational knowledge for my next phase of my career in my adulthood, but it still had little to do with building my financial education.

2nd Place to Live – New State, New School District

Huntington Beach, CA – 7 years

In 2003, I packed up everything I owned and moved to Southern California where I moved to teach in the Los Angeles Unified School District (LAUSD) for 15 years. All my friends and family warned me not to move because it would be too dangerous, too smoggy, and too expensive, but none of those things deterred me from my path. For about seven years, I lived along the coastline in Huntington Beach, with a landlord, a couple roommates, and lots of wealthy neighbors. Due to my new location, I was learning many new financial skills that I would have never picked up living in the rural country towns.

Long Beach, CA – 8 years

In 2010, I moved from Orange County to Los Angeles County, California, and still remained working for both the same two education companies mentioned above. I went from rural, to suburban, to urban living in twenty years, and they all have their pros/cons with money/finances. My lesson from all those living experiences is that I would prefer to live alone on a secluded island (currently, I am living as a nomad, and that is suitable until I find my special place).

2nd & 3rd Degrees – New University

Masters Degree in Curriculum Instruction & Technology

From 2005 through 2006, I went to University of Phoenix online to earn my masters in education with a specialization in curriculum design, instructional methods, and educational technology. At the time, I was working in LAUSD as an instructional technology coach for a tech-grant and wrote my masters thesis on working with 7th and 8th grade math and science teacher how to integrate new technologies into their classrooms: smartboards, projectors, laptops, remote assessment devices, digital library, and tons of technical support through coordinators, coaches, and administrators. I was excited to be exercising my skills learned in school with my multiple teaching jobs.

Doctoral Degree in Educational Leadership & Educational Technology

In 2009, I started my doctoral journey that lasted 11 years, and the end of the story will happen next week. This was the final phase of my educational journey before I started my next career in the next part of my adulthood. What I want to point out is, after ALL these years in school, I only had one year of personal finance, and 25 years of student loan debt!

2nd Marriage & Divorce – New (ex)Husband

In my next relationship, we both came from a divorce, and waited seven years to get married again. Both my marriages were 10 years apart, lasted a couple years each, the weddings were quite small, no kids, and separated by equally splitting assets/debts. I did the process by myself by checking out books from the library, making copies at work, completing the paperwork, and filing at a specified date/time by the courts where we would meet for a final time to sign the papers. The biggest financial lessons learned from both my marriages/divorces were the credit card debt spent for the weddings, even though they were small, and then still paying on them while splitting the debt in the divorces.

Conclusion on My Firsts & Seconds in Young Adulthood

Many lessons were learned, and hopefully I will be blessed with many more lessons to come with where I live, work, and who I love that are constantly changing with each new phase of my life. There is only one thing I can say that I am happy about my financial journey during this young adult stage is at 32, I started putting money into an annuity. At the time, I had no idea what it was, didn’t really care, but thought it would be a good idea to start investing in my future somewhere. That was the seed that started my first adult financial literacy lesson as I enter into my forties.

To be continued…My financial education journey from 40 to present will be shared a week from now on, Wednesday, October 26, 2022.

Thank you for reading and viewing,

I am so impressed on how your life turned out. It seems like from a young girl you have been learning life skills. You have a lot to be proud of! Hugs from Lia and me! 💞

Sorry about your divorces. Thrilled at your PhD. Also sorry you didn’t love Long Beach as much as I did.

So much happened in such a short time! I feel that we all should take a look back and look at all we’ve done and endured.