October 12, 2022

Education (financial) Wednesdays

Welcome back friends to Education Wednesdays on my B.R.E.A.T.H.S. blog. For this month, I am holding this space to share my financial education journey for each of the decades I have been through, where I am at, and where I plan to be. For each of the four weeks I will be transparent, honest, and forthcoming with successes and burdens with my financial education through the years as a means to reflect and grow my financial literacy knowledge.

My Financial Education Journey: Teen Years

The first week in October, I shared about the first decade of my experiences with money and a family of four children under ten living with our single mother. Our lives dramatically changed after that with the introduction to not one, but two step fathers. This second week, I will discuss my financial education journey from about eleven to 18 years of age.

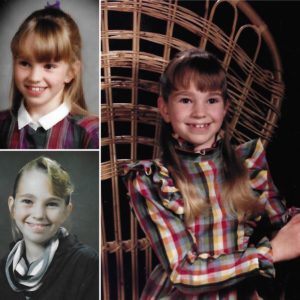

4th grade to 6th grade (10-12yrs old)

After the first decade with a single mom, she married for the first time, and that lasted five years. My fourth grade year, I was working my first job at a snack food stand at the local ball field where my payment was in snacks, so I had to up my money game. By my 5th grade year at 12, I was old enough to babysit for cash, so I started seeking parents at the church I attended. News of my skills spread fast and it seemed like I was babysitting for the entire city.

7th grade to 8th grade at Middle School (13-14yrs old)

By middle school, I was the lead babysitter at my church daycare, and had a more regular income. With all this money coming in, I had no idea what to do with it other than buy things that I really wanted, which were nice accessories for school (leather jackets, Esprit bags, and Ked’s shoes). Those middle years I became more self conscious with my body changes, getting my hair permed, and somehow developing what my mom calls, “bang disease,” which thankfully I quickly grew out of.

9th grade to 11th grade (15-17 yrs old)

My mom was divorced by my freshman year of high school and remarried again my junior year. In my sophomore year, I got my driver’s license, and was able to expand my babysitting services to more rural areas of my small town, or in the bigger neighboring cities. You would think I saved some money for my first car with all my babysitting money, but after getting some used cars from my family, I didn’t make that a priority.

I am 18, an Adult

Just a few months into my senior year I turned 18. I made it through school with honors, scholarships, and a sense of satisfaction for working so hard to get good grades, and was ready for college (which turned out to be another 25 years of school). Out of ALL those years in school, my senior year had the one and only class on personal finance, right before I ventured off into adulthood. That is the point of me writing this financial education blog, because in hindsight, there was very little financial literacy along my journey. So, did things change as a young adult?

Looking forward to seeing more of this journey. It is shocking to me how little we learn about money as kids. Most of it is simply learned through observation and most of us aren’t growing up watching people who were making supportive financial choices!

BINGO! Observation is key, I am so glad you commented that, and are picking up what I am throwing down! Kids don’t know to ask about money, and my mom was very quiet when it came to finances until it was bill time, and then things would tense up. So that is what I learned to do when it came to money. I thank my mom for what she taught us and told her its not her fault we didn’t know about financial literacy because this is how the majority of the population was taught by their previous generations. Future generations can change that cycle by discussing money and finances with children as soon as they can speak. Regardless if they can talk, kids will always be watching, so caretakers of children should definitely be mindful of how they act around finances. Sending lots of love, Jaime

What an interesting childhood! While I didn’t learn a lot on finances when I was young, I did observe my parents always saving money at the grocery store. We weren’t wealthy by any means, both my parents worked andy grandparents lived with us. Mom and dad always saved a certain amount of money each week, even if only a few dollars. I know I got my shopping, meal planning and saving smarts from my parents and grandparents. To this day, I’m like my parents, always say “We’re saving for when we got old.”

Hello Martha, I admire the way your family had such a tremendous impact on your financial literacy. My mom did her best with coupons, WIC support, and cooked what she had as a means of meal planning, but I never saw her with/around money, it was almost like a secret.Thank you for sharing how your family discussed financial literacy. I am very curious how others talked about money, or lack there of, and the impact it had on their lives. Much gratitude for you reading and commenting. Sending love, Jaime.