Wednesday, April 5, 2023

Welcome back friends to Education (financial) Wednesdays on my B.R.E.A.T.H.S. blog. For this month, I am holding this space to share my financial education journey in the year which has been drastically different from how I managed my finances in the past. I realized with the recession we are in that now is the best time to get started on readjusting everything I know about financial literacy and each week this month I will be sharing with you the strategies I have learned. This first week in April, I am sharing about a book I came across last year called, “Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine,” by Mike Michalowicz, and it helped me completely change my money management.

“Profit First” Core Principles

Chapter 2 of “Profit First” describes the “smaller plate” strategy to dish out smaller portions of money into different accounts. This strategy is described in four core principles: 1. Use smaller plates, 2. Serve sequentially, 3. Remove temptation, and 4. Enforce a rhythm (Michalowicz, 2017). You might be wondering how plates relate to money. In this case, we will think of the plates like envelopes or different bank accounts. Either way, we will be learning how to use less money to do more and pay ourselves first.

-

Small Plates

Money comes in and is dispersed into different accounts so that we can pay ourselves first, not ever paying bills first. The book is written for entrepreneurs in mind and gives the examples of five accounts: profit, owner’s comp, tax, and operating expenses (opex). I have a nonprofit (which doesn’t pay taxes) so I created some different accounts, four for both my personal and business accounts:

Personal Accounts: Profit, Bills, Emergency Savings, and OPEX (food, fun, gas) with two different banks, a regular chain bank found in all states, and a local teacher’s credit union, with two accounts each, a checking and savings account.

Nonprofit Accounts: Profit (savings) and OPEX (checking-payroll and business expenses)

-

Serve Sequentially

Mike suggests always allocating money based on percentages and moving money to each account before bills are paid (Michalowicz, 2017). If there is not enough money left for bills, this will require me to start examining spending and eliminating unnecessary expenses (Michalowicz, 2017). After one month of implementing these strategies and checking my cash flow accounts daily, I was starting to see the things I needed to cut out and other things that were my nonnegotiable (did not want to cut).

-

Remove Temptation

The reason I have two different personal bank accounts is to help me have four different accounts (two checking, two savings) is so that I can have one bank as my easy access to pay bills and keep an emergency savings, and the other is the credit union that is not as easy to access where I keep my profit in the savings and the checking is used for my OPEX (food, fun, gas). This helps to remove temptation to borrow from myself and improves my money accountability (Michalowicz, 2017). For my nonprofit accounts, I am still in the beginning stages of my business and have not generated enough profits to have more than two accounts. When I start to gain more profits, I will start allocating the money based on my business plans and proposals.

-

Enforce a Rhythm

The book specifically suggests allocating and paying bills twice a month, on the 10th and 25th to get into the rhythm and see how cash is coming in and going out (Michalowicz, 2017). This part is the most difficult for me because I have only been paid a teacher’s salary on the first of the month for the last twenty years. However, I do budget quite differently now after using the first three core principles, I have the rhythm of doing my allocating and paying on the first, and will start to enforce the suggested rhythm when my nonprofit businesses start bringing in funds. I used to have too much month at the end of the money, but after implementing these core principles, I only spend what I have allocated in each account so there is enough no matter the beginning or end of the month.

Action Steps

- Have faith that this process works, step out of your comfort zone, and try this new way of budgeting if you have not already started.

- Rename one your bank accounts, PROFIT.

- Begin allocating 1% into that account, starting small to make it a simple and manageable process.

Allocation Percentages

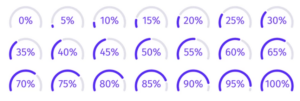

Chapter 5 of “Profit First” describes how to create percentages for your allocation accounts in two ways, Current Allocation Percentages (CAPS) and Target Allocations Percentages (TAPS), with CAPS being our starting point and TAPS being our end goal (Michalowicz, 2017). Since my nonprofit business is in startup stages, our CAP is zero percent, but we aspire to reach 20% as the business grows, the allocations will grow, presumably one to two percent every quarter. Successful implementation of the Profit First strategies will help us create a series of small, simple incremental steps (Michalowicz, 2017).

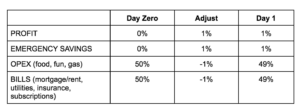

Chapter 6 of “Profit First” helped me to start implementing the core principles and allocations. The example of my allocation percentages in table above is similarly based on Michalowicz (2017) examples. However, I have changed the accounts and allocations to fit my personal bank accounts (not nonprofit accounts) with my fixed monthly income paid out on the first of every month. The CAP percentages will be bumped up or down a percent each quarter to keep up with the rhythm until I get to my desired TAP percentage of 10% profit and 10% emergency savings, and my ultimate goal of 20% profit TAP.

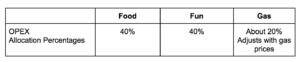

Because I have a fixed monthly income, I break down my OPEX account as seen above (I keep a digital monthly tracking spreadsheet in Google Sheets), and aspire to move from the digital small plates to physical envelopes. The amounts change from month to month as my budgeting strategies improve, but for the most part the percentages stay the same. With the exception of the gas allocation, that changes based on the current gas prices that seem to keep going up so my food and fun have been adjusting down a bit. I have a 16 gallon gas tank and fill up once a week, so I multiply current gas prices by 16×4 and I get my weekly gas allocation that is about 20% of my OPEX percentages.

Destroying Debt

Chapter 7 focuses on how businesses can cut back on debt by saving more and spending less, based on principles learned from another financial expert author, Suze Orman, who says “the key to getting out of debt is simple, you must enjoy saving money more than spending it” (Michalowicz, 2017). So how does one start destroying mountains of debt? Below, I will explain how I started destroying my debt.

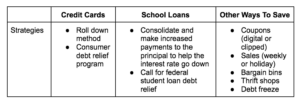

Examples of How I am Destroying My Debts (see chart above)

First, I hired a debt relief program to take over paying off my three credit cards (not available in all states, but I used my CA address). If you are in a state that doesn’t allow debt relief programs, Suze Orman suggests the roll-down method to pay off the highest interest cards first and work your way down. Next, I promised myself I would never use a credit card again. Instead of using credit, I now budget for things that I want and start allocating new accounts/percentages to work towards saving instead of the impulsive spending I am used to.

Finally, I contacted a federal school loan debt management company (available in all states) to help me get all my student loans consolidated into one account and put on an income-driven payment plan. Now, I am making saving even more fun by looking for coupons (digital or clipped), sales (weekly and holiday), and shopping from bargain bins or at thrift shops. Michalowicz (2017) also suggests a debt freeze that will cut costs (stop spending on frivolous things) that is explained in detail in Chapter 7.

Advanced “Profit First” Techniques

In Chapter 9, Michalowicz (2017) suggests waiting until two full quarters before implementing the more advanced techniques and also making sure you are allocating biweekly on the 10th and 25th as stated above. You can begin to customize your accounts to fit your learning style and saving methods.

- The Vault – (low-risk interest-bearing account) a three month reserve, this is also called an emergency savings

- Stocking Account – savings to fund big purchases

- Pass-Through Account – mostly for travel funds when you know you are going to be reimbursed, the money comes out and goes back into this account

- Drip Account – allocated for advanced payments and retainers

- Petty Cash Account – funds for gifts, meals, etc

- Prepayment Account – many businesses offer prepayment or payment in full for services that offers a discount (insurance, courses, masterminds, etc)

- Document the process – I use Google Docs so that I can easily access this info, I also keep a Google Sheet to keep track of my cashflow and allocations

- Hiding Accounts – what you don’t see, you don’t spend, banks can hide accounts

- Account Snapshot – set up automatic notifications of balances

- Consistency – keep practicing, tweaking, and advancing your systems

Live the “Profit First” Lifestyle

Chapter 10 details how to begin your “Profit First Lifestyle” Michalowicz (2017):

- Add up all the bulls and debts owed

- Put a freeze purchases you can’t pay cash for

- Establish Profit First habits with automatic bank transfers

- Create your foundational accounts

- Income

- The Vault

- Recurring payments

- Day-to-day

- Debt destroyer

- Big life events

- Cut up credit cards and start using cash

- Cut back everywhere you can

- Celebrate your financial success

- Lock in your lifestyle

- Seek out free options

- Never buy new

- Never pay full price (unless you can’t avoid it)

- Negotiate alternative prices

- Delay big purchases

- Get your family involved – use envelope method for children to start saving

- Big dreams

- Help family (groceries or entertainment)

- Impact (donations for charities)

- Vault for emergencies

- Mad money for needs/wants

Conclusion on Profit First

Whether you are trying to budget better in your personal life or wanting to learn how to budget with your business, the Profit First book has the necessary steps to get you started. This book will help you learn how to create allocated bank accounts, distribute your income, resist temptation, start saving, stop spending, get out of debt, and get into the rhythm of living a Profit First lifestyle. To learn more about the Profit First book and systems follow Mike Michalowicz YouTube channel.

Thank you for reading,

Dr. Jaime Brainerd, E.d.D.

Reference

Michalowicz, M. (2017). Profit first: Transform your business from a cash-eating monster to a money-making machine. New York, NY. Penguin Random House, LLC.

I hadn’t really heard about this method of money management, but I will have to check it out. Perhaps we need to make s few adjustments! LOL Thanks for sharing!

As soon as I left my job ,I paid up my debt and try to follow saving first method of money allocation. Interesting post.Will check out the book.